Is Net Working Capital An Asset In Business?

Contents:

On the opposite side of this spectrum, trying to lengthen your payment cycle for vendors can improve your working capital. Reach out to your vendors for longer payments plans so that your dues are better spread out. Volopay is tied up with multiple vendors who offer such competitive prices. If your NWC balance sheet is becoming a cause for concern, then there are multiple ways in which you can improve the total at the bottom.

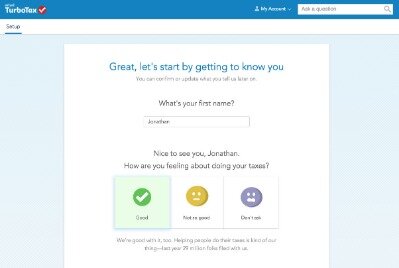

Net working capital, also called NWC or working capital, measures a company’s short-term financial health. NWC shows the difference between a company’s current assets and current liabilities, and the remaining dollar amount is the company’s working capital for the immediate future. Optimize your processes to reduce liabilities and increase current assets, and gain greater competitive strength with a positive net working capital balance.

Connect With a Financial Advisor

In particular, inventory may only be convertible to cash at a steep discount, if at all. Further, accounts receivable may not be collectible in the short term, especially if credit terms are excessively long. This is a particular problem when large customers have considerable negotiating power over the business, and so can deliberately delay their payments.

- Unlike inventory, accounts receivable and other current assets, cash then earns a fair return and should not be included in measures of working capital.

- The following working capital example is based on the March 31, 2020, balance sheet of aluminum producer Alcoa Corp., as listed in its 10-Q SEC filing.

- This metric is used to measure the liquidity of a business and indicates short-term financial strength.

- Your historical working capital levels are reviewed over the last several years monthly.

- Without it, business owners will likely find themselves in a hairy financial situation where they cannot meet their obligations.

Companies with a negative net working capital may struggle to pay their short-term obligations and may need to take out loans or other forms of financing to cover their expenses. Analysts and lenders use the current ratio as well as a related metric, the quick ratio, to measure a company’s liquidity and ability to meet its short-term obligations. A working capital ratio of less than one means a company isn’t generating enough cash to pay down the debts due in the coming year.

If you tie up your working capital line of credit on these expenses, it won’t be available for its intended purpose. We are committed to being the best working capital option to our customers as we look for ways to better serve them every day. While having a positive net working capital is generally seen as beneficial for businesses, there are some potential drawbacks to having too much of it. Businesses can also consider exploring alternative financing options such as factoring or invoice financing which allow them access to funds quickly without affecting credit ratings.

Most companies need working capital well above zero because accounts receivable and inventory take time to convert to cash and sometimes prove uncollectable or unsellable. Retailers, restaurants, and other companies that quickly generate cash from accounts receivable and inventory often require less net working capital. A business with low or negative net working capital may struggle to pay its bills over the next year. Failure to raise additional funds could result in severe liquidity issues or even bankruptcy. When you have a negative net working capital, this says to investors and creditors that the company is not producing enough capital to pay its current debts.

How to Improve Net Working Capital

However, the more practical metric is net working capital , which excludes any non-operating current assets and non-operating current liabilities. Yes, it is bad if a company’s current liabilities balance exceeds its current asset balance. This means the company does not have enough resources in the short-term to pay off its debts, and it must get creative on finding a way to make sure it can pay its short-term bills on time. For example, new equipment may improve operations, but its value begins to deteriorate immediately, reducing current assets.

Current liabilities include accounts payable, wages, taxes payable, and the current portion of long-term debt that’s due within one year. When a working capital calculation is negative, this means the company’s current assets are not enough to pay for all of its current liabilities. The company has more short-term debt than it has short-term resources. Negative working capital is an indicator of poor short-term health, low liquidity, and potential problems paying its debt obligations as they become due. Net working capital is one of the most helpful measures of a company’s success. To maintain day-to-day operations, you need to be able to cover your short-term obligations, such as rent, utilities and payroll.

This approach is most appropriate when a how to calculate stockholders equitys history reveals a working capital that is volatile and unpredictable. It is also the best way of estimating non-cash working capital for very small firms that may see economies of scale as they grow. While these conditions do not apply for the Gap, we can still estimate non-cash working capital requirements using the average non-cash working capital as a percent of revenues for specialty retailers of 7.54%. The fourth is to base our changes on the non-cash working capital as a percent of revenues over a historical period.

Let’s take an example to understand the calculation of Change in Net Working Capital formula in a better manner. Calculate the change in net working capital by taking a difference of the calculated working capitals. We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. The treasuryXL Partner Program is designed for organizations offering products or services in treasury, cash and risk management.

Determine Current Assets from the company’s balance sheet for the current and previous period. Calculating net working capital gives you crucial information about your company’s short-term financial health. Managing net working capital effectively will help ensure your business can pay its bills over the next year without hoarding excessive cash or inventory. ABC Company owes accounts payable of $50,000, accrued expenses of $90,000, and long-term debt of $200,000, with $40,000 due this year. Current liabilities equal $180,000 ($50,000 accounts payable plus $90,000 accrued expenses plus $40,000 long-term debt due this year).

Datarails’ FP&A software replaces spreadsheets with real-time data and integrates fragmented workbooks and data sources into one centralized location. This allows users to work in the comfort of Microsoft Excel with the support of a much more sophisticated data management system at their disposal. So, whatever your ecommerce store’s cash needs, asset-based finance with Myos offers a rapid and low-risk solution to get working capital. With first revenues, you’re flexible to pay back the first installment & receive new goods. Get a payout – Negotiate with the supplier or simply use his inventory while Myos will pay the financing amount to you or the supplier.

NET WORKING CAPITAL FORMULA EXAMPLE

Refinancing can stretch out payment schedules and lower monthly payments, providing more cash for working capital. Since the change in net working capital has increased, it means that change in current assets is more than a change in current liabilities. Net working capital, often referred to as working capital, equals current assets minus current liabilities. Current assets include any assets a business expects to sell or consume within a year, while current liabilities fall due within a year. Therefore, net working capital shows how much a company’s short-term resources exceed amounts due within a year. Capital, like data, drives the day-to-day operations of businesses around the world.

In fact, we would recommend that once working capital is being managed efficiently, the working capital changes from year to year be estimated using working capital as a percent of revenues. For example, consider a firm that has non-cash working capital that represent 10% of revenues and that you believe that better management of working capital could reduce this to 6% of revenues. You could allow working capital to decline each year for the next 4 years from 10% to 6% and, once this adjustment is made, begin estimating the working capital requirement each year as 6% of additional revenues. Table 10.12 provides estimates of the change in non-cash working capital on this firm, assuming that current revenues are $1 billion and that revenues are expected to grow 10% a year for the next 5 years. Working capital is calculated from current assets and current liabilities reported on a company’s balance sheet.

This means that the business has $115,000 in working capital to continue operations. Your small business banker can help you better understand your working capital needs and what steps you may need to prepare for any situation. While you can’t predict everything about running a company, a clear view of working capital can help you operate smoothly today — and set you up for long-term growth tomorrow. To illustrate how much of a change each of these assumptions can have on working capital requirements, Table 10.11 forecasts expected changes in non-cash working capital using each of the approaches. In making these estimates, we have assumed a 10% growth rate in revenues and earnings for the Gap for the next 5 years.

Working Capital and the Balance Sheet

Businesses should also consider investing in technology to automate processes and reduce manual labor costs. Additionally, businesses should review their pricing strategies to ensure they are competitive and maximize their profits. Finally, businesses should consider diversifying their customer base to reduce their reliance on any one customer. Accounting for working capital according to the terms outlined in the LOI will result in easier negotiations over the working capital target and create fewer post-closing adjustments. Sellers should have a skilled investment banker to correctly calculate and define net working capital and evaluate and negotiate the target working capital. Datarails is an enhanced data management tool that can help your team create and monitor cash flow against budgets faster and more accurately than ever before.

Jourdan Closes First Tranche of Private Placement – Yahoo Finance

Jourdan Closes First Tranche of Private Placement.

Posted: Fri, 21 Apr 2023 21:00:00 GMT [source]

Cash monitoring is needed by both individuals and businesses for financial stability. Novo Platform Inc. strives to provide accurate information but cannot guarantee that this content is correct, complete, or up-to-date. This page is for informational purposes only and is not financial or legal advice nor an endorsement of any third-party products or services. Novo Platform Inc. does not provide any financial or legal advice, and you should consult your own financial, legal, or tax advisors. Be sure to audit your financial statements regularly to determine whether there are opportunities to streamline cash inflow and outflow. For the past two years, you’ve been bringing in $10,000 per month and kept operations lean by working as a solopreneur and using older equipment.

For most companies, working capital constantly fluctuates; the balance sheet captures a snapshot of its value on a specific date. Many factors can influence the amount of working capital, including big outgoing payments and seasonal fluctuations in sales. Positive working capital means the company can pay its bills and invest to spur business growth. Negative Cash FlowNegative cash flow refers to the situation when cash spending of the company is more than cash generation in a particular period under consideration. This implies that the total cash inflow from the various activities under consideration is less than the total outflow during the same period.

- Working capital is important for businesses because it is a key indicator of the financial health of the company.

- Making sure that your warehouses or inventory have a consistent flow of materials incoming and product outgoing can help provide a steady stream of profitable income.

- Many factors can influence the amount of working capital, including big outgoing payments and seasonal fluctuations in sales.

- Companies with a negative net working capital may struggle to pay their short-term obligations and may need to take out loans or other forms of financing to cover their expenses.

- Datarails’ FP&A software replaces spreadsheets with real-time data and integrates fragmented workbooks and data sources into one centralized location.

Both figures can found in the publicly disclosed financial statements for public companies, though this information may not be readily available for private companies. Working capital estimates are derived from the array of assets and liabilities on a corporatebalance sheet. By only looking at immediate debts and offsetting them with the most liquid of assets, a company can better understand what sort of liquidity it has in the near future. Working capital, also called net working capital, represents the difference between a company’s current assets and current liabilities. When yourefinance short-term debtwith long-term debt, you can reduce your current liabilities.

Small business owners use net working capital to better understand their company’s immediate financial health. Finance teams at large companies and corporations also commonly use NWC. Additionally, accountants can calculate and track NWC for clients with ease because accountants create financial statements that show the details needed for the NWC formula.

Net working capital differs from the current ratio because it provides a dollar amount rather than a percentage. A business with current assets equal to current liabilities has a net working capital of $0 and a current ratio of one. Small companies could have a high current ratio but not enough working capital to meet any unexpected cash needs. Conversely, large companies with positive working capital but a low current ratio might need additional working capital. Finally, net working capital is a more sensitive measure of liquidity than total assets.

New Small Business Funding Program Launched » CBIA – CBIA

New Small Business Funding Program Launched » CBIA.

Posted: Fri, 21 Apr 2023 18:37:57 GMT [source]

Similar to the time limit on asset calculations, any liabilities that don’t need to be paid within a year are not counted. These include your inventory, your accounts receivable, as well as any cash you may have (or cash-adjacent assets, like the company’s bank balance). If you’re unsure about what constitutes an asset, then there is a simpler way to recognize it. If an asset can be liquidated within a year’s time without having a major negative impact or considerably high cost , then it is a current asset.

Lisata Therapeutics Receives $2.2 Million of Non-Dilutive Capital Through New Jersey Technology Business Tax Certificate Transfer Program – Yahoo Finance

Lisata Therapeutics Receives $2.2 Million of Non-Dilutive Capital Through New Jersey Technology Business Tax Certificate Transfer Program.

Posted: Thu, 20 Apr 2023 12:30:00 GMT [source]

In Actual Working Capital Example A , the actual working capital delivered at the close is $5.7 million due to a $1 million increase in accounts receivable due to increased sales. Based on AI and Machine Learning, our algorithm allows us to evaluate the product data and determine the financing volume without requiring additional credit checks from you. A business can increase its working capital by taking on debt, increasing its sales volume, or gaining some kind of working capital financing. Contrary, if a company doesn’t have enough working capital, it could be forced out of business because it can’t pay its bills or payroll. It can be used to measure both liquidity and solvency — two things that are crucial for any business.